It is perhaps the most common, and paralysing question facing aspiring Australian property owners today: "Should my first purchase be a home to live in, or an investment property?"

Twenty years ago, the answer was usually simple: buy your first home. But today, with capital city prices sky-high and the general cost of living crunching household budgets, the traditional "Great Australian Dream" of buying where you want to live immediately is becoming harder to achieve.

At CH Secure, we see many investor-minded individuals stuck at this crossroads. They want to enter the market before prices rise further, but they also want to maintain their current lifestyle near work and amenities in areas they cannot currently afford to buy into.

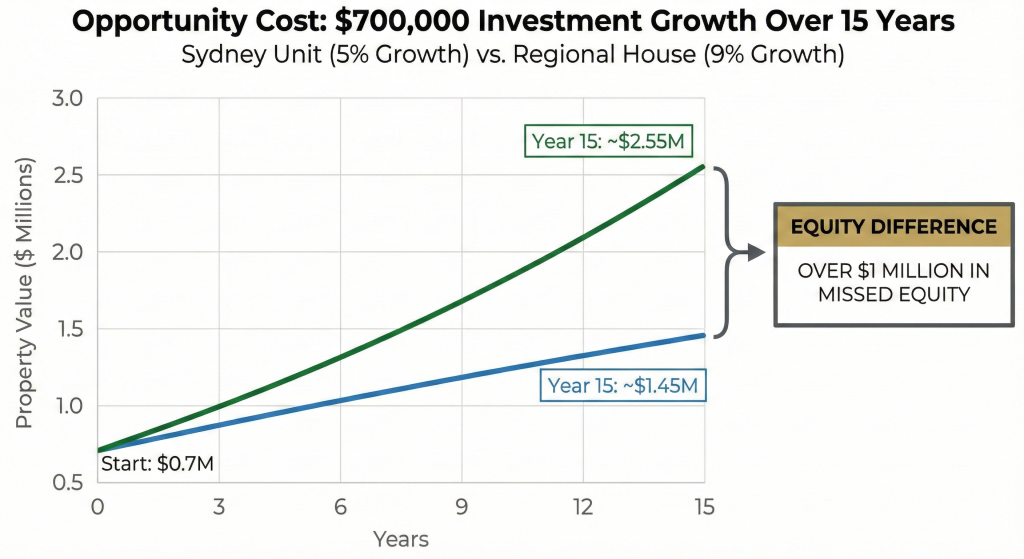

The $700,000 Question: Understanding Opportunity Cost

To understand why the investment route is often superior, you must grasp "opportunity cost."

Let’s assume a $700,000 budget. In a metro hub like Sydney, that likely secures a studio apartment. That same $700,000 could buy a standalone house with land in a high-growth regional town.

Units generally suffer from oversupply issues, often averaging around 5% growth per annum. Conversely, well-selected houses with scarce land content historically outperform, frequently achieving 8–10% per annum over the long term of at least 15 years.

Over a 15-year period, the compounding difference between 5% growth on a metro unit versus perhaps 9% on a strategic regional house isn't just spare change; it’s potentially over $1 million in missed equity. That is the true cost of buying an inferior asset just because you want to live in it. The key reason for this difference is simple, more people want a house, and will work harder to achieve that dream.

Units can absolutely do well in shorter bursts, like the affordability-driven demand we’ve seen in recent years, but eventually this trend will regress to the mean as markets typically do.

The Strategic Shift: Why Rent-Vesting Makes Sense Now

Given the current economic climate, the smartest path for many first-timers is shifting away from emotionally driven owner-occupier purchases toward strategic investment. This often leads to "rent-vesting", renting where you want to live, and buying an investment property where the numbers make sense.

We advise buyers to get a clear picture of their finances and to educate themselves about the tax implications and benefits of both sides. Speaking to your accountant is a good start. Gathering advice from licensed professionals will help you formulate a plan. The decision you make to either rent-vest or become an owner occupier can then be based on an objective understanding and what's best for you and your current situation.

Ultimately, a Buyers Agent can not provide you financial advice, but when you have developed a clear understanding of your situation and your property goals, we can step and execute a plan that ensures you succeed on your property journey.

How CH Secure Helps You Grow Wealth

If you buy an owner-occupier home based purely on emotion and max out your borrowing capacity, you might stunt your future financial growth.

At CH Secure, we help you bypass the emotion and focus on the data. Our Buyers Agents secure investment-grade assets in areas poised for capital growth, ensuring your first purchase acts as a robust stepping stone to future wealth.