Rising buyer confidence due to anticipated rate cuts is only going to push up prices further. It may be time to pivot your strategy, step off the sideline and get into the market before the big rush. Unfortunately, if you held off from buying in 2023, you’ve missed out on some excellent capital growth. 2024 is showing signs that there areas still plenty of opportunities out there.

Prop Track Price growth year-to-date from January to November 2023 and predictions for growth in 2024

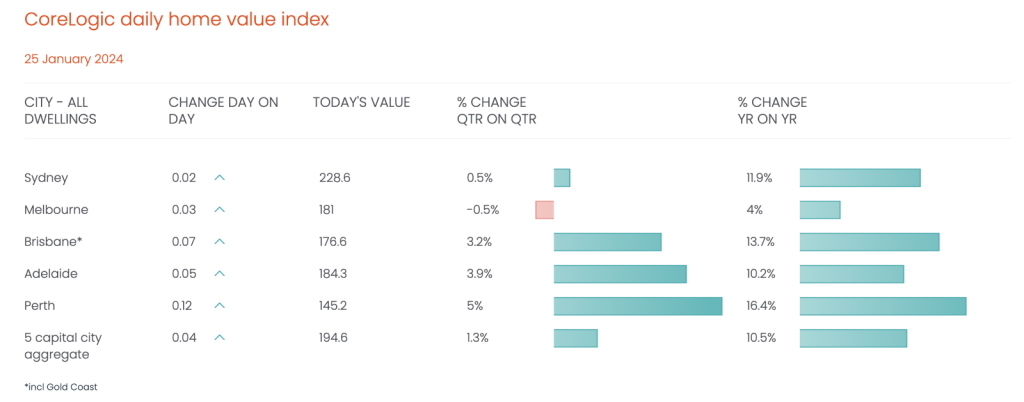

PropTrak’s 2023 December Outlook notes 2024 forecasted growth to be 5-8% in Perth, 4-7% in Adelaide, 3-6% in Brisbane and 2-5% in Sydney. Keep in mind these are conservative estimates and represents a wide range of areas within those cities. Suburbs that CH Secure are researching and currently buying in are expected to achieve at least 10% growth over the year.

A note from the CH Secure’s Director

Josh Meli firmly believes that “the growing conversation about rate cuts is already improving consumer confidence, when you combine this with the eventual RBA cut, we’ll see first home buyers and investors start to re-enter affordable markets and push prices up further.” With that said, the longer you sit out of the Australian property market, the less opportunity you’ll have to maximise your current deposit and borrowing power.

Big Banks Rate Cut Predictions

Depending on how unemployment and inflationary pressures pan out in 2024 and the Reserve Bank RBA’s economic response to this, many people and financial experts are expecting or suggesting a rate cut somewhere in second half of 2024.

| Bank | First Rate Cut Prediction | Rate forecast |

| CommBank | September 2024 | 2.85% by end of 2025 |

| NAB | December 2024 | 3.10% by end of 2025 |

| Westpac | September 2024 | 3.10% by September qtr 2025 |

| ANZ | November 2024 | 3.60% by mid 2025 |

This is great news for people who are looking to get back into the market but by that point, you may be up against more buyer competition.

Prices rises due to rising demand and restricted supply

With already constricted supply of property in all major cities and rising consumer confidence, prices are likely to rise further in 2024.

Our team at CH Secure is ready to help you step off the sidelines and establish a proactive plan and strategy that’s geared towards your long-term financial goals. Feel free to get in touch with our team who can source property Australia-wide and negotiate the best price for you.