Imagine a massive, heavy wheel. Initially, it takes considerable effort to push and get it moving. But once you get it spinning, its own momentum ensures it keeps turning with increasing speed and less effort. That's what a flywheel does in machinery. When transferred to business or investment strategies, it represents a self-sustaining cycle where every component feeds into and amplifies the next. With each turn, the momentum builds up, and the system becomes more efficient and profitable.

Now that we understand the basic concept, let's explore a proprietary approach to building a thriving property portfolio using not just one, but two interconnected flywheels.

The Infinite Property Flywheel Approach to Property Investment

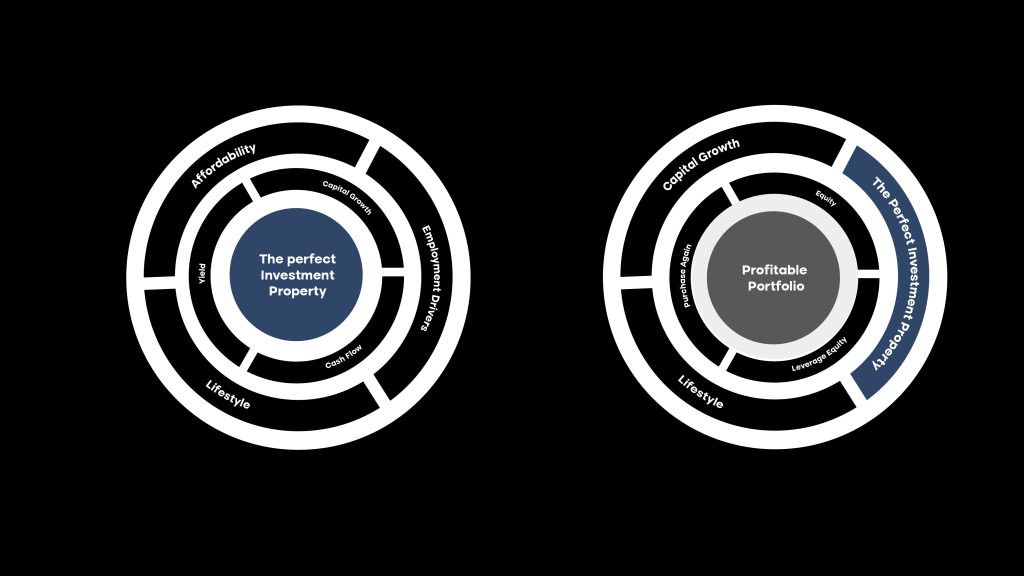

Flywheel 1: Identifying the Perfect Investment Property

External Drivers: Think of the outer wheel as the surroundings, the environment in which the property exists. This includes:

Affordability: Investing in properties that are affordable to current incomes

Lifestyle: Choosing properties that cater to modern living preferences.

Infrastructure: Opting for properties around significant infrastructure developments.

Employment drivers: Investing in areas close to major employment hubs.

Internal Results: If you've nailed the external drivers, the inner wheel naturally follows. It signifies:

Capital Growth: The increase in property value.

Cashflow: The regular income generated from the property.

Yield: The return on investment based on the property’s value.

At the intersection of these external drivers and internal results, you find 'The Perfect Investment Property'. This property embodies all the qualities of a solid, growth-oriented investment.

Flywheel 2: Building a Profitable Portfolio

External Driver: The outer component here is driven by the result of Flywheel 1. It's all about having The Perfect Investment Property as your foundation.

Internal Processes: With the right property in hand, the internal mechanisms can kick into action:

Equity: Over time, as your property appreciates, you build equity.

Leverage Equity: With sufficient equity, you can borrow against it.

Purchase Again: Use the leveraged equity to invest in another 'perfect' property.

Right at the core of this flywheel is your end goal - a 'Profitable Portfolio'.

Piecing it Together

These two flywheels don't exist in isolation. They are interconnected in an infinity arrangement, signifying an endless loop of growth and reinvestment.

Start with identifying the right property based on external drivers. This will lead to results in the internal circle, leading to the 'perfect investment property'. Now, using this property as a steppingstone, begin the process of equity creation, leverage, and reinvestment, and watch as your portfolio grows profitably.

So, next time you're pondering the strategy for property investment, visualise this dual flywheel. It's a roadmap, a cycle, a machine—all set-in motion to guide you to success. And remember, the beauty of a flywheel is that once it gains momentum, the sky is the limit!