Tightening Vacancy Rates in Affordable Locations

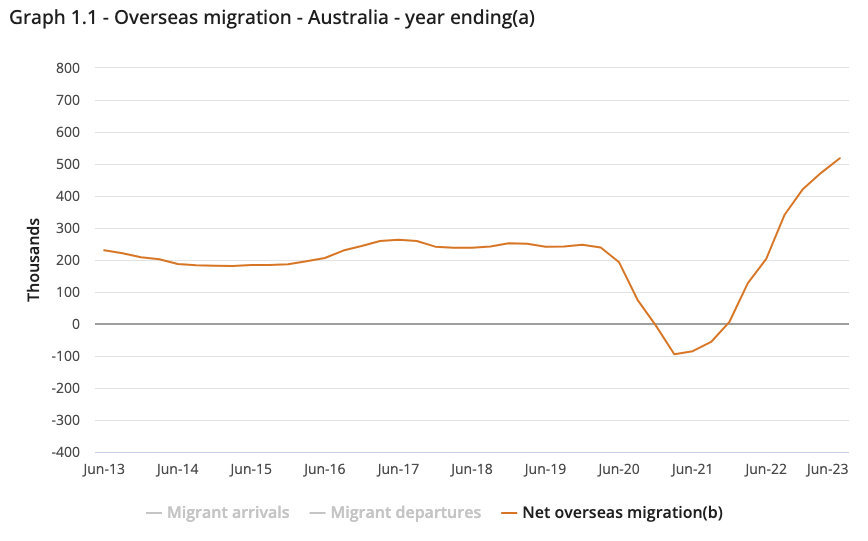

Across the country, vacancy rates have taken a steep dive over the past several years as a result of economic factors such as interest rates rises in 2022-23, increases in international migration and constrained supply of new homes hitting the market.

For many areas in each major city, these factors have been at play but It’s important to understand what’s really driving the vacancy rate down for a particular area before you decide to invest there. At CH Secure we look at investing in areas that have growth drivers such as lifestyle, employment, infrastructure upgrades or developments.

What Are Vacancy Rates?

Vacancy rates indicate the availability of rental properties within a specific area. A lower vacancy rate suggests higher demand for rentals, potentially leading to increased rental yields and property values over time. This figure is calculated by dividing the total number of available rental listings by the total number of rental properties. An excellent source for finding out an area’s vacancy rate can be found at SQM Research’s website

Vacancy Rates Overview

Perth and Adelaide are emerging as hotspots for investors, boasting record-low vacancy rates of 0.4% and 0.5%, respectively, compared to Sydney and Melbourne’s 1.3% and 1.1%.

CH Secure is currently targeting areas within these cities which are below the 1% mark, or trending towards this, as they have the potential to provide greater rental returns and future price growth.

Key Areas of Interest

Queensland, South Australia, and Western Australia are garnering attention from investors due to their affordability, lifestyle appeal, and economic opportunities for owner occupiers and renters.

The latest migration levels have surged, with significant gains in population observed in these regions. The Australian Bureau of Statistics shows 2022-23 net migration of 83,990 people in Queensland, 27,860 in South Australia and 61,590 people in Western Australia.

Target The Right Low Vacancy Rate Areas Investors often fixate on low vacancy rates and soaring yields as indicators of lucrative investment opportunities, overlooking the crucial factor of location sustainability. While these metrics may initially appear promising, neglecting to assess the underlying drivers of demand can lead to unforeseen risks.

Take, for instance, the case of Gracemere in Queensland, currently hailed as a hotspot for investment due to its minimal vacancy rates and escalating yields. However, a closer examination reveals a dependency on fly-in-fly-out mining families, rather than a diverse range of industries driving local employment and lifestyle choices.

This reliance on a single economic driver poses a significant risk. Should the mining industry experience downturns or if resource reserves deplete, the demand for rental properties in Gracemere could plummet, leading to a rapid increase in vacancy rates.

At CH Secure, we advocate for a holistic approach to investment, emphasizing the importance of evaluating not just current market conditions but also the underlying fundamentals driving sustained growth. By leveraging our expertise and comprehensive analysis, investors can mitigate risks and identify opportunities with long-term viability, ensuring consistent returns on their investments

Get in touch with us today for expert advice and guidance with your next investment.