Identifying the Best Suburbs to Invest in Property for 2026: 3 Areas We’re Keeping an Eye On

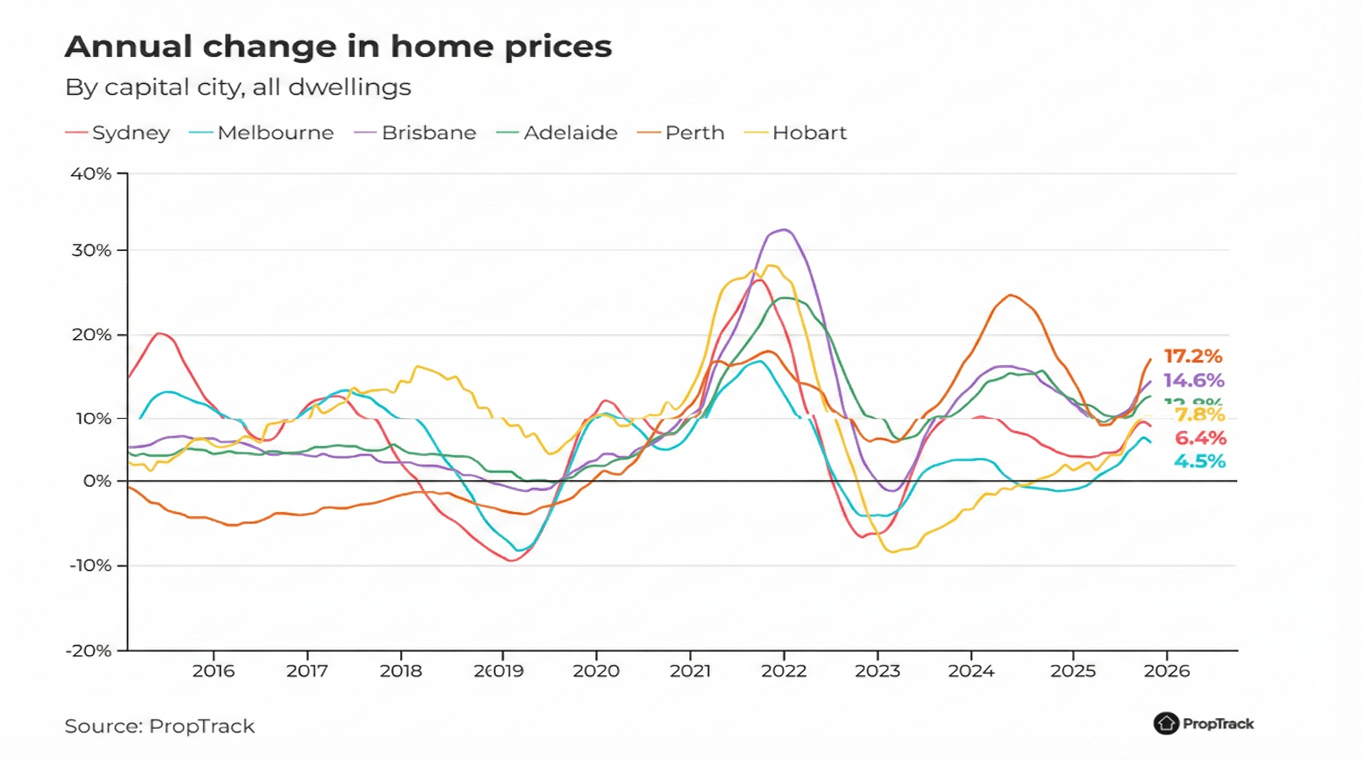

2025 was a strong year for property investors. The question is whether 2026 is going to offer the same kind of growth, Cotality’s latest report suggests otherwise due to inflation concerns, affordability constraints and the ‘higher for longer’ sentiment towards interest rates.

2026 is the year to be more selective on where you buy and what to buy. Gone are the days when you could simply throw a dart anywhere Australia wide and achieve double digit capital growth.

From a macro point of view, which areas performed the best last year?

2026 is the year to be more selective on where you buy and what to buy. Gone are the days when you could simply throw a dart anywhere Australia wide and achieve double digit capital growth.

From a macro point of view, which areas performed the best last year?

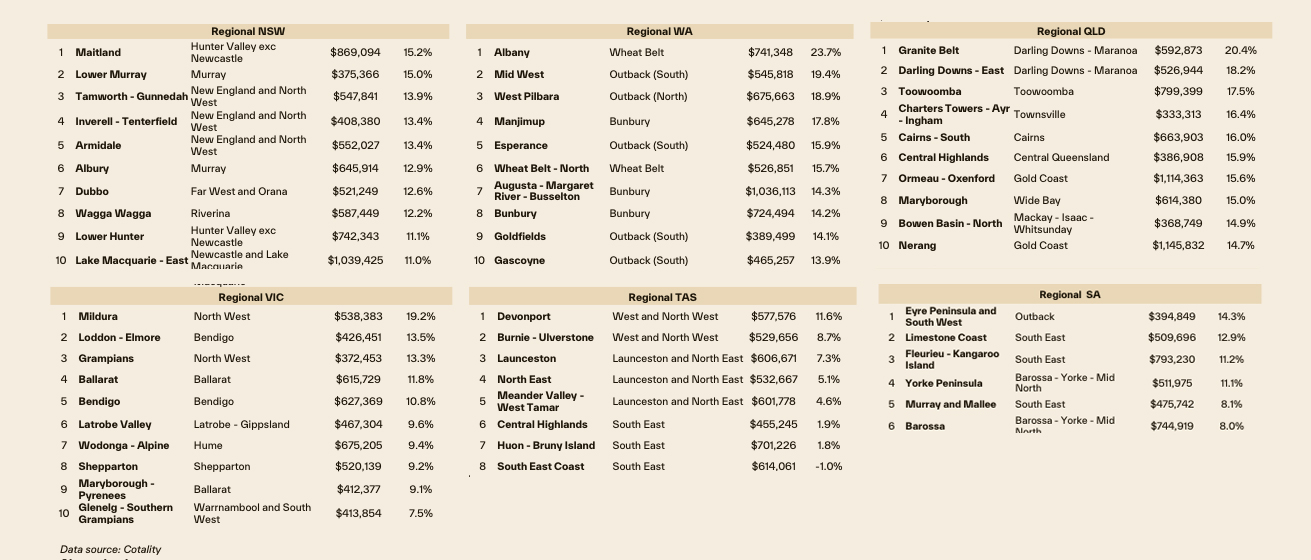

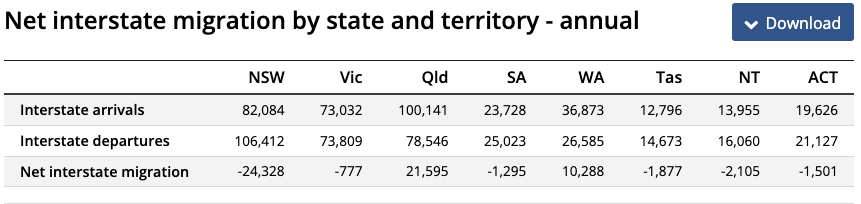

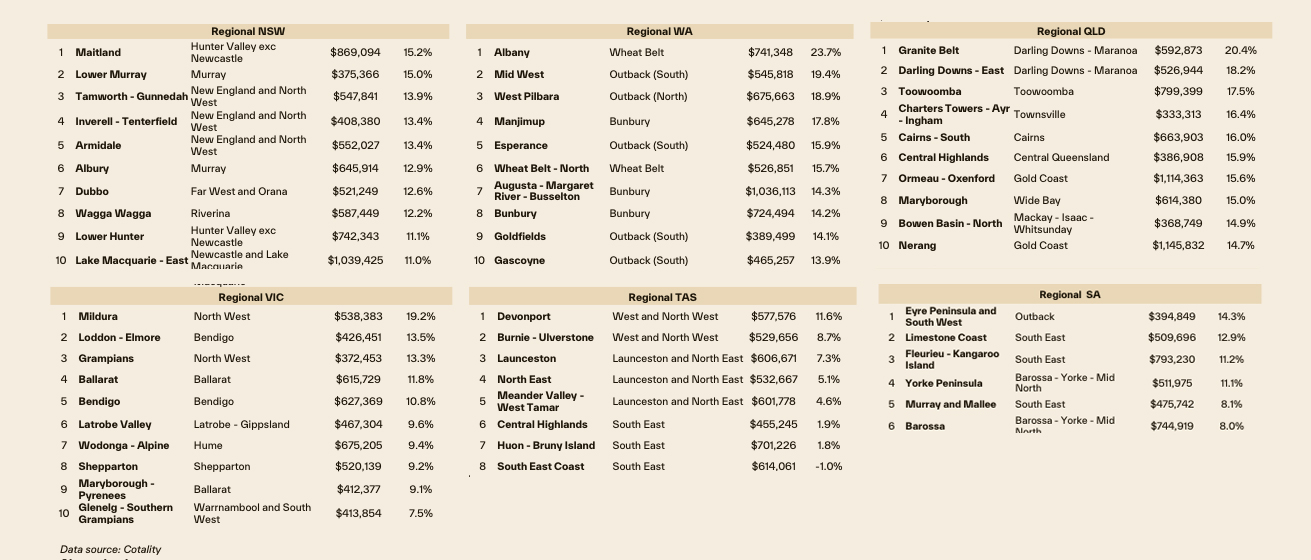

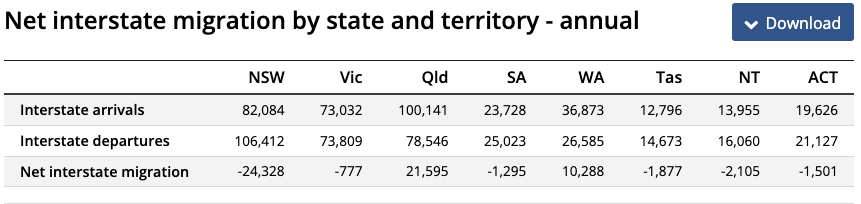

It comes as no surprise, regional centres performed exceptionally well due to their relative affordability compared to capital cities and also due to consistent interstate migration.

It comes as no surprise, regional centres performed exceptionally well due to their relative affordability compared to capital cities and also due to consistent interstate migration.

Fundamentals

Fundamentals

2026 is the year to be more selective on where you buy and what to buy. Gone are the days when you could simply throw a dart anywhere Australia wide and achieve double digit capital growth.

From a macro point of view, which areas performed the best last year?

2026 is the year to be more selective on where you buy and what to buy. Gone are the days when you could simply throw a dart anywhere Australia wide and achieve double digit capital growth.

From a macro point of view, which areas performed the best last year?

It comes as no surprise, regional centres performed exceptionally well due to their relative affordability compared to capital cities and also due to consistent interstate migration.

It comes as no surprise, regional centres performed exceptionally well due to their relative affordability compared to capital cities and also due to consistent interstate migration.

SO, WHERE ARE THE BEST OPPORTUNITIES FOR PROPERTY INVESTORS IN 2026?

Last year, we bought some outstanding investment properties across regional Queensland, Tasmania and Victoria. Check out the 3 examples below. We also dive deeper into why we bought into these regions further down.Hansen Street, Urangan QLD

- Purchase Price: $580,000

- Configuration: 3 bed | 1 bath | 3 car

- Land Size: 775m²

- Purchased: Feb 2025

- Current Value: $700,000

Steele Street, Devonport TAS

- Purchase Price: $405,000

- Configuration: 3 bed | 1 bath | 2 car

- Land Size: 530m²

- Purchased: Jul 2025

- Current Value: $510,000

Halbert Street, Wendouree VIC

- Purchase Price: $495,000

- Configuration: 3 bed | 2 bath | 1 car

- Land Size: 530m²

- Purchased: Oct 2025

- Current Value: $520,000

High Growth Investment Areas To Keep An Eye On In 2026

Tasmania (Northern & Affordable Corridors)

Fundamentals

- Entry price points remain attractive relative to mainland capitals, especially across northern pockets.

- Tight rental conditions in many sub-markets continue to support yield and demand.

- Supply isn’t easy to ramp up quickly, which helps underpin pricing when demand lifts.

Key Drivers

- Infrastructure investment across northern Tasmania is improving connectivity, amenity and confidence.

- Population inflows are supporting both tenant demand and owner-occupier depth.

- Lifestyle migration (value + pace of life) remains a consistent tailwind.

Why it stays on our watch list

Northern Tasmania is still in that early to mid stage where fundamentals look strong and upside can be captured without paying peak pricing, but only if you’re selective on suburb, street quality and local supply constraints.Victoria (Outer Melbourne + Regional Hubs: Geelong, Ballarat & surrounding)

Fundamentals

Fundamentals

- Deep buyer demand from both owner-occupiers and investors creates liquidity.

- Population growth and internal migration continue to support long-term housing demand.

- Established employment and services in key hubs strengthens market resilience.

- Major state-dependent infrastructure projects are reshaping access, employment nodes and amenity.

- Improving lifestyle appeal (cafes, schools, health, waterfront/green space) draws higher-quality demand.

- Ripple affordability effect: as inner areas become less attainable, demand pushes outward to quality outer pockets and strong regional centres.

South Australia (Onkaparinga Region, South of Adelaide)

Fundamentals

- Natural land constraints (coastline + hills) limit outward expansion in many pockets.

- Growing owner-occupier appeal supports price stability and long-term uplift.

- Improving amenity profile continues to lift the quality of demand.

- Transport and connectivity upgrades into the CBD reduce friction for commuters.

- Demographic uplift: increased inflow of higher-income households as liveability improves.

- “Land-locked” dynamic means desirable, well-positioned stock can become scarce quickly.